Rebecca (Becky) Hoyt

Email: [email protected]

Phone: 802-889-3571

Office hours:

Monday through Friday, 9 a.m. to noon

Tax Payments

You can pay your property taxes via MuniciPAY using:

- Check

- Cash

- Money Order

- Visa, MasterCard, Discover, American Express (service fee will apply, see below)

- Electronic Check Payments (service fee will apply, see below)

Credit card payments made in office or via telephone

The Town of Tunbridge offers the convenience of accepting MasterCard, Discover, American Express and Visa credit cards for property tax payments. The payment processing company charges a service fee of 2.65% or $3.00 minimum to cardholders who use this service. Just stop by our office or give us a call at 802-889-3571 to use your MasterCard, Discover Card, American Express or Visa.

Credit card payments made online

Now you can pay your property taxes from the comfort of your home or office by using our online payment service. Credit cards accepted: MasterCard, Discover, American Express or Visa. A per transaction service fee of 2.65% or $3.00 minimum will be charged by the payment processing company for this service.

Electronic check payments

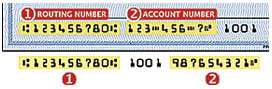

The Town of Tunbridge now accepts electronic check payments using our online payment service. Payments will be charged to your checking or savings account at your bank. You will need your 9-digit routing number, as well as your account number from your personal checks (see example below). A per transaction service fee of $1.50 will be charged by the payment processing company for this service.

IMPORTANT: When Payment Options appear, click on the “Switch to Pay with Check” link and then continue entering your information.